In private equity, the buyouts of large-cap companies usually attract the most public attention, but the lion’s share of the action actually happens in the mid-market. Around 90% of buyout deals take place here according to Preqin. These are investments in well-established, successful, medium-sized businesses with considerable potential for growth and opportunities for what private equity calls ‘value creation’.

What is mid-market private equity?

Definitions of what constitutes the private equity mid-market vary depending on geography, economy, and frankly, the manager, but broadly it comprises the segment of the market occupied by companies that are too large to be classed as SMEs, but smaller than large cap companies.

In the UK and Europe, it’s useful to think about companies with enterprise values of £10m-£300m. In the US though, the upper end of that range could be closer to $1bn. A significant scope of opportunity exists in this segment. In the UK alone there are almost 40,000 medium-sized businesses - five times more than there are large companies. When small and medium-sized enterprises (SMEs) are combined, they account for 99.8% of the total business population2.

Given the size of the mid-market, the opportunity set for potential transactions is higher than in the large-cap market. Target companies will have a solid position in their field, yet have potential to seize greater market share or move into new markets, by expanding into new geographies or innovating new products or services.

As such, their outlook is typically ambitious, bold and agile. Some are still family-run and would benefit from operational change and professionalisation. These ‘value-creation’ levers are less available to PE investors in large caps because companies of that size have already professionalised, and their larger size makes them less nimble and able to enact change quickly.

Examples of highly successful private equity mid-market investments include the management buyout of drinks company Fever-Tree. With its private equity sponsor supporting operational improvements, international expansion and financial growth, Fever-Tree's enterprise value had doubled by the time of its IPO within just 18 months3.

Investing in the mid-market presents a wide range of value-creation opportunities.

The dynamics of mid-market deals offer significant opportunities for value creation compared to large caps in a number of ways:

Lower initial valuations

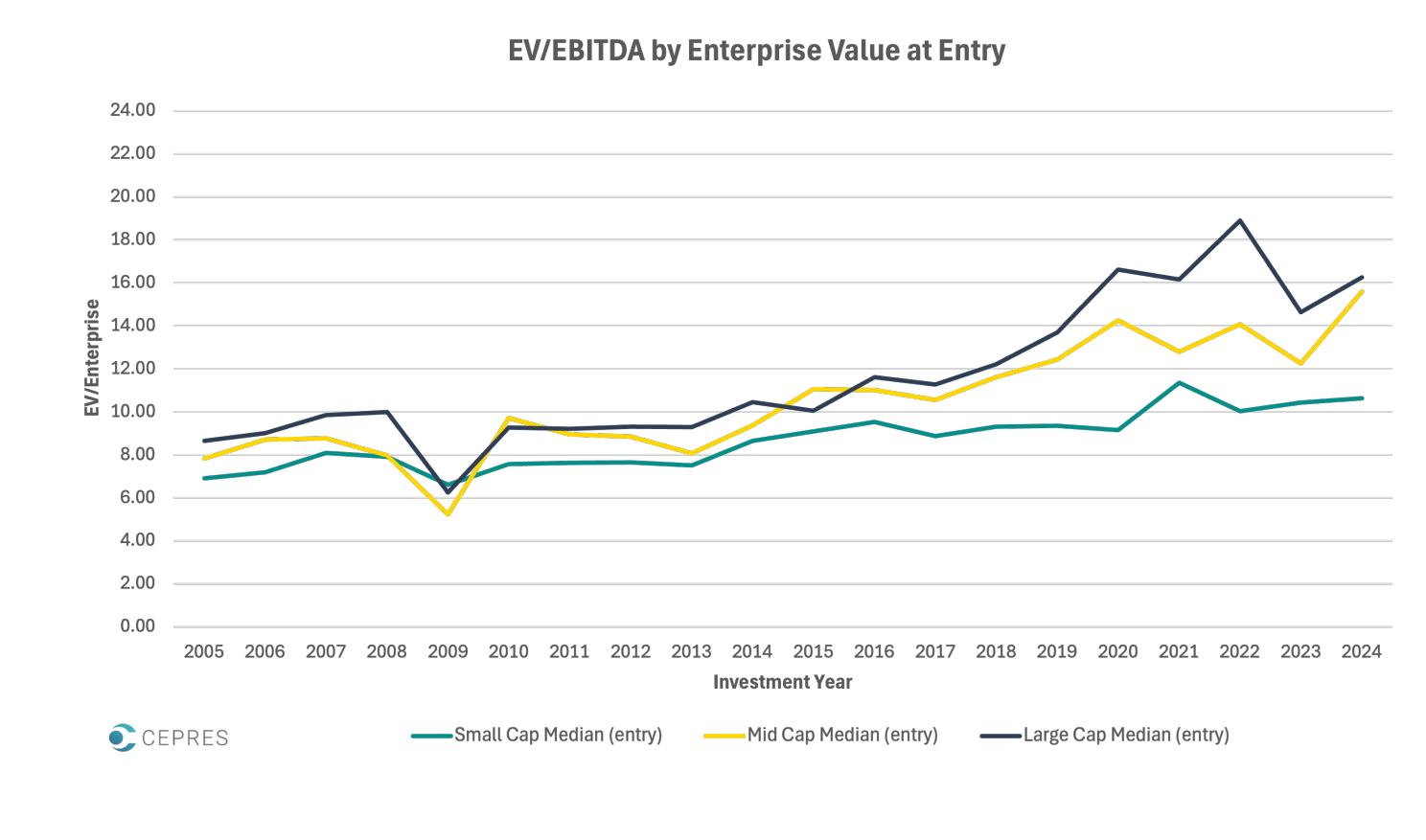

Large deals tend to cost more on entry - not just in absolute terms, but in relative terms too, so greater scope for value creation in mid-market deals is embedded from the get-go. Over the past five years or so, entry multiples for large-cap deals have tracked consistently higher than the entry multiples averaged by mid-cap deals, according to market intelligence data provider CEPRES4.

More room to grow

Smaller companies still have plenty of growth potential – they may still be scaling up and there are several strategies at their disposal to achieve greater market penetration. As well as targeting organic growth, the often fragmented nature of the markets mid-caps operate in means they can take advantage of ‘buy-and-build’ platform strategies or targeted acquisitions of complementary businesses. By contrast, large caps may be nearing or have already achieved market saturation point, while expansion or consolidation opportunities require major investment which often yields diminishing returns.

Less leverage

Most PE deals require debt financing, but traditionally, large-cap deals have been more highly leveraged, and this has been a fundamental driver of performance. As the BVCA puts it, “Evidence suggests that leverage effects on value creation are higher for larger deals as big buyouts tend to be more leveraged compared to private equity mid-market investments.” However, in today’s high interest rate environment, which raises the cost of servicing debt and puts cashflow under intensifying pressure, growing companies through this kind of debt-dependent financial engineering is becoming increasingly challenging.

Greater operational efficiency and agility

Mid-caps tend to be operationally leaner and more nimble than their larger competitors, moving faster to seize new opportunities or to implement strategic changes. Whereas layers of bureaucracy and greater operational complexity can slow large corporates’ decision-making processes down and hamper their adaptability, mid-market management teams can be more focused, better able to monitor developments closely and intervene quickly where necessary.

Expansive exit prospects over a shorter time period

Smaller companies are frequently good targets for trade sales to competitors looking to consolidate their market position, bolt on complementary businesses or buy in innovation. Since such acquisitions are strategic, buyers may be prepared to accept higher prices. They may also be attractive to other private equity firms looking to continue the value creation trajectory.

Potential to deliver higher returns

From June 2022 to March 2024, mid-cap buyouts achieved an annualised return of 10.06%, compared to 5.34% for large-cap investments, highlighting mid-market resilience amid rising inflation and interest rates6.

The impact of 'hands-on' asset management and specialist expertise

In today’s uncertain, lower growth economy, and as financial engineering (through the use of high levels of debt aka ‘gearing’) loses momentum as the critical driver of returns, simply adopting a ‘buy-and-hold’ strategy, which is typical of the large cap funds, is no longer enough for private equity investors to succeed.

To drive more value, the onus is now on sponsors to take a more hands-on approach to pull all the value creation levers available to them, maximising value and generating alpha returns through proactive means.

It’s often the case that, since PE sponsors at the larger end of the market tend to have more diversified portfolios, their focus is prone to being diluted across multiple investments, leading to less effective execution of value creation strategies. Mid-market players have the advantage of being able to dedicate more resources and attention to each investment. At the same time, in the large cap space, sponsors can face challenges in achieving margin expansion due to the scale and complexity of the business’ operations, while mid-market firms tend to be in a better position to identify and implement operational improvements.

The expertise and capabilities of the investment manager are critical here. Those with specialist skills and experience in a particular area and/or that focus on niche markets in which they have deep knowledge will be better placed than generalists to spot undervalued companies or overlooked opportunities.

They will have developed tried-and-tested playbooks to deliver business optimisation. This may include professionalising businesses by bolstering leadership teams with high-quality hires for core senior roles, appointing board members to strengthen governance, or undertaking business transformation strategies such as modernising operational processes. Fund managers may get involved in honing portfolios companies’ growth plans, setting goals and prioritising activities, and provide vital guidance on issues like pricing, product roll-outs or cost reduction initiatives.

As time goes on, sponsors will continue to have an important role to play in monitoring business performance and providing ongoing support. But in order to do this successfully, they must, from the very outset, develop good relationships with leadership built on trust and ensure that their priorities and those of the management team are aligned.

How does mid-market performance compare?

Our analysis of market data reveals that:

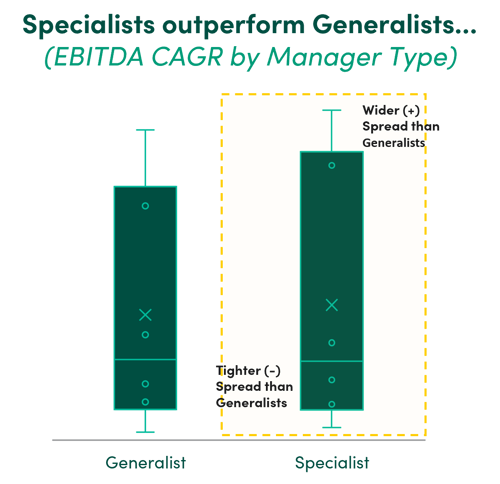

1. Companies owned by specialist funds exhibit significantly higher EBITDA compound annual growth rates (CAGR) than those owned by generalists.

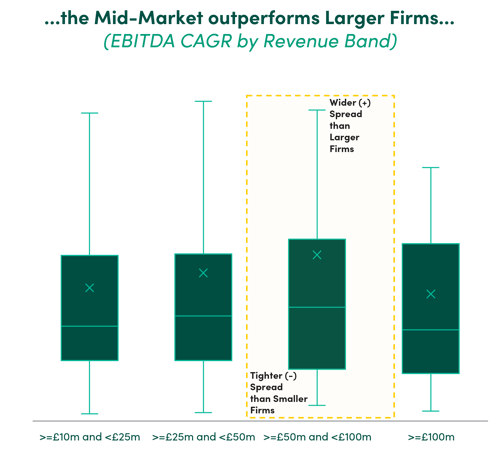

2. When combined with the mid-market’s outperformance of large caps, data suggests the best private equity primary investment returns are likely to come from mid-market investments managed by a sector specialist, as the graphs below show.

3. Combining a mid-market investment strategy with a specialist manager rather than a generalist can result in superior investment returns.

Overall, mid-market funds show strong performance across vintages: for example, over the past 35 years, European mid-sized buyout funds have delivered a net internal rate of return ('IRR') of 16.6%, compared to 15.1% in the large buyout segment7. No wonder large cap private equity managers are increasingly moving into the mid-market arena8.

Managers with extensive mid-market expertise and a large-cap platform can be particularly attractive to investors. They can differentiate themselves from pure mid-market managers by leveraging the benefits of their wider platform resources. For example, a more extensive team of professionals with investment, portfolio management, and capital markets skills and experience across geographies can more easily provide on-the-ground support, create a larger deal origination funnel, and leverage a greater array of tools in their investment playbooks.

Enduring reasons for the mid-market’s growing popularity

The mid-market is enduringly and increasingly popular with private equity investors because there’s so much breadth of opportunity, so much scope for value creation by backing ambitious businesses with high growth potential, and such attractive market dynamics in terms of exit routes and returns profile.

But investing in the mid-market requires commitment, energy and specialist skills to spot the best opportunities, understand the risks, and to execute sustainable growth strategies. This is not the place to invest passively: fund managers that offer a differentiated approach and that are prepared to roll up their sleeves and support portfolio businesses throughout their growth journey should see the greatest rewards in the long term.

Register to view our private equity fund opportunities

Important note

As with any kind of investment - investors must realise the nature and risks of what they are investing in, and bear in mind the potential downsides of investing in mid-market private equity as well as the upsides.

The type of investments offered by Connection Capital for self-selection by its professional clients are high risk and speculative. Investing places investors’ capital at risk and they could lose all of your money. There is no guarantee of investment return or distributions and past performance is not a reliable indicator of future results. The investments are illiquid and are not readily realisable or easily transferable until the exit point.

Sources:

- Preqin

https://www.preqin.com/insights/research/reports/deal-flow-monitor-q1-2024 - Gov.uk

https://www.gov.uk/government/statistics/business-population-estimates-2024/business-population-estimates-for-the-uk-and-regions-2024-statistical-release - LDC

https://ldc.co.uk/portfolio/fever-tree-doubling-enterprise-value/ - CEPRES

https://www.linkedin.com/pulse/shifting-valuations-private-equity-why-smaller-deals-stealing-spotlight-gpdef/ - BVCA

https://www.bvca.co.uk/research/external-research-hub/leverage.html - QIC

https://www.qic.com/News-and-Insights/Private-equity-and-the-middle-market-the-what-why-who-and-when - Invest Europe

https://www.investeurope.eu/news/opinion/don-t-miss-the-middle-the-outperformance-of-mid-market-european-private-equity/ - PEI

https://www.privateequityinternational.com/lps-shift-to-the-mid-market-story-of-the-year/