The start of the year is a natural time for investors to assess their current asset allocations and consider their investment strategy for the next 12 months. We believe investing in private markets will feature strongly, as a necessary counterweight to investments in public markets.

With private markets forecast to be worth $20 trillion by the end of the decade (up from $13 trillion today)1, and returns from alternative assets like private equity performing strongly, it’s no surprise that more and more private investors want a piece of the action. While interest has been growing steadily for some time, there are several good reasons why 2025 could offer strong opportunities in this space.

In the macroeconomic context, with the major events of 2024 behind us – namely the significant political uncertainty created by the UK and US elections – we can now expect a greater degree of stability in terms of the policy environment. Rachel Reeves has set out her stall for better or worse in the Budget, and despite the inevitable unpredictability of the incoming Trump administration, there is at least some clarity about the likely direction of travel in key policy areas. What does seem certain is that interest rates will continue their downward trajectory, with one forecast predicting that US federal funds rate will fall to 3.5% in 2025, and the Bank of England base rate to 3.33%2.

For those investors who are long in cash, now is the time to consider putting some of that capital to work to generate better potential returns. And there are many people in this category: research indicates that 13 million UK adults are sitting on £430 billion of cash savings3.

Taking a strategic approach to asset allocation

Against this backdrop, taking a strategic approach to asset allocation is key, incorporating assets with different risk profiles and investment horizons into the mix to increase diversification. Investors are increasingly aware that private investments, such as private equity and private debt, have an important place in a well-balanced portfolio alongside public equities and bonds, and are making space for them accordingly.

According to one survey, wealth managers expect around 11% of their sector’s assets under management (AUM) to be made up of private market investments by 2030, compared to just 5% in 20214. Our own client research suggests that this may be conservative, with 76% of our experienced private investors allocating over 10% of their portfolio to alternative investments, and 4 in 10 allocating over 20%. The main reasons cited are the outsize return potential offered by private market investments and diversification from public markets.

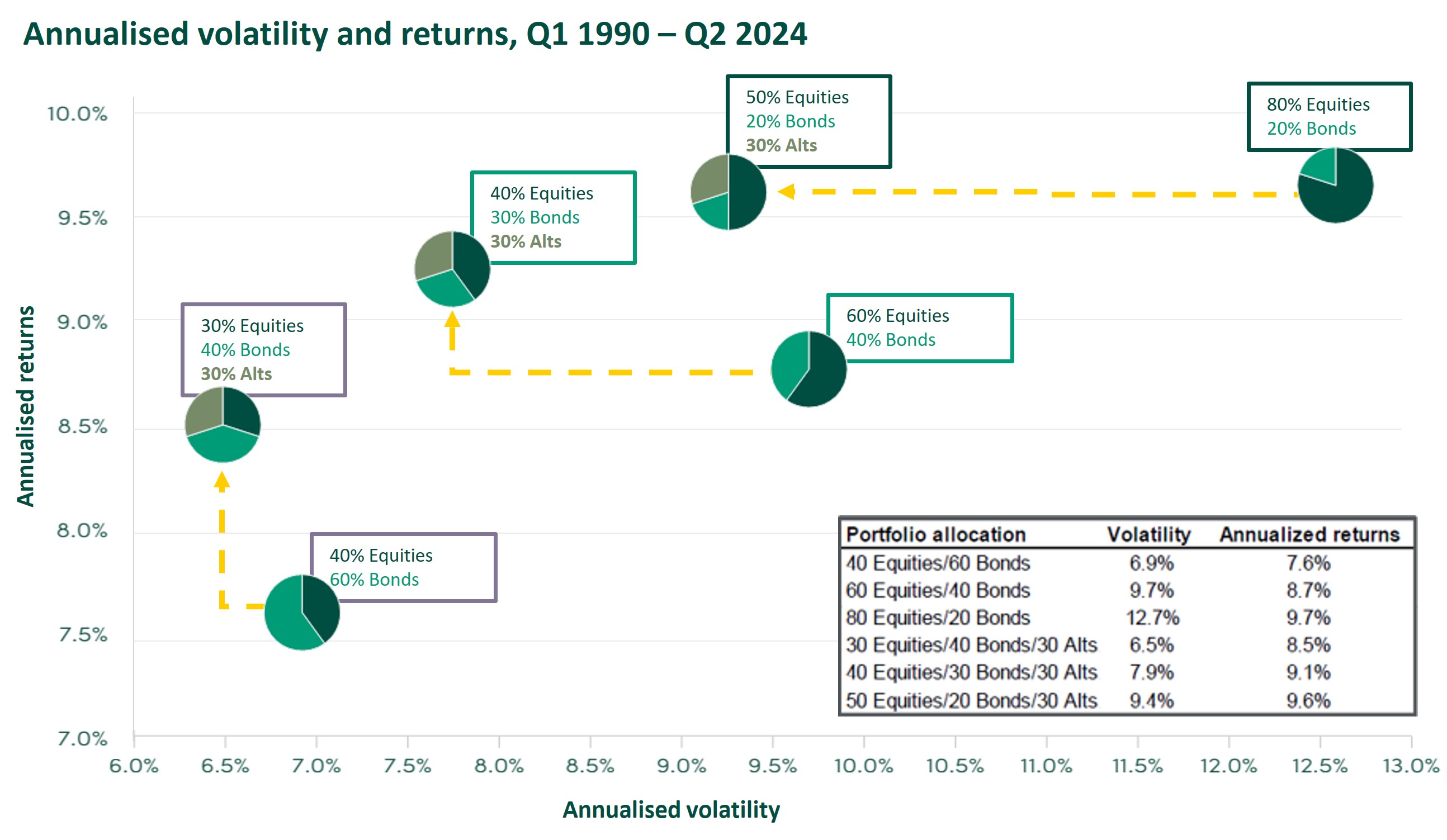

Indeed, studies show that alternative assets are capable of delivering impressive risk-adjusted returns and reducing overall portfolio volatility. Research by JP Morgan5 using data from Q1 1990 – Q2 2024 puts annualised returns for portfolios with a traditional 60:40 equities/bonds split at 8.7%, with a volatility rate of 9.7%. By replacing some of the equity and bond mix with a 30% allocation to alternative investments, performance improved to 9.1% and volatility dropped to 7.9%. This allocation to alternatives is shown below to have a positive impact on returns and volatility across a range of equity/bond portfolio ratios.

Source: JP Morgan

Investing in private equity in 2025

Current asset pricing looks attractive and many analysts view UK assets as undervalued. Figures suggest the UK stock market’s price-to-earnings (P/E) ratio is relatively low (at 16.31) compared to the US (27.11), Canada (18.52) and France (17.82)6, making it prime time to take UK listed companies private. Meanwhile, with the UK’s IPO market in the doldrums after an extremely subdued 20247, exposure to private markets provides an important, and often only, route for investors to access the most exciting growth companies.

As bank interest rates fall and cash loses its lustre, 2025 could also see a renewed focus on yielding investments, such as private debt strategies – a market which has matured significantly in recent years. Banks’ retrenchment from lending to small and medium-sized businesses8 is one reason why the asset class has grown rapidly, reaching approximately $1.5 trillion at the beginning of last year, compared to $1 trillion in 2020, and by 2029 private credit is predicted to hit $2.6 trillion9.

Many businesses appreciate the greater flexibility this kind of borrowing provides, given that private lenders are not bound by the same rigid terms and conditions as banks, creating a wider scope of opportunities for investors, particularly in the lower-mid market10. A diverse range of strategies is available too, from direct lending to mezzanine loans, distressed debt and speciality finance. And while falling interest rates will put some pressure on returns compared to recent years, they are nonetheless expected to remain attractive, typically in the high single digits11.

As we reach the mid-point of the decade, the rationale to maintain large cash reserves or stick solely to public markets looks less compelling than ever before, while private markets have gone from niche to mainstream in their accessibility and appeal.

With a greater degree of clarity returning to the economic outlook, 2025 is a good time to reassess if existing strategies are still fit-for-purpose, whether portfolios are sufficiently diversified and what new opportunities are out there for the taking. Have you asked yourself these questions?

Important note

The type of investments offered by Connection Capital for self-selection by its professional clients are high risk and speculative. Investing places investors’ capital at risk and they could lose all of your money. There is no guarantee of investment return or distributions and past performance is not a reliable indicator of future results. The investments are illiquid and are not readily realisable or easily transferable until the exit point.

Sources:

- Preqin, September 2024, Carne Atlas, August 2024. https://www.blackrock.com/institutions/en-us/insights/private-markets-outlook

- Statista, statista.com/statistics/1429525/policy-interest-rates-forecast-in-europe-and-us/ (Accessed 7 Jan 2025)

- Barclays, home.barclays/news/press-releases/2024/09/the-uk-investment-gap--p430-billion-in-cash-savings-not-invested/

- Carne Group, ftadviser.com/investments/2024/07/03/private-markets-to-grow-rapidly-but-regulation-remains-complex/

- JP Morgan, Guide to Alternatives Q4 2024. am.jpmorgan.com/gb/en/asset-management/adv/insights/market-insights/guide-to-alternatives/

- World PE Ratio, worldperatio.com/area/united-kingdom/ (Accessed 15 January 2025)

- EY, ey.com/en_uk/newsroom/2025/01/london-stock-market-ends-2024-on-a-high-after-q4-boost

- City AM, cityam.com/big-banks-shun-demand-for-sme-lending-as-larger-firms-prioritised/

- Preqin, Future of Alternatives 2029 Report, December 2024. www.morganstanley.com/im/en-gb/intermediary-investor/insights/articles/private-credit-outlook-2025-opportunity-growth.html

- Muzinich & Co, muzinich.com/opinions/corporate-credit-outlook-2025-private-markets

- alterDomus, alterdomus.com/insight/private-debt-outlook/