Chief Investment Officer Michael Mowlem explains what to look out for in private markets over the coming months.

In 2024 nearly two billion people around the world participated in national elections. Yet, across developed nations, no governing party saw an increase in its vote share. The most common reason for this global discontent is surely the continued economic malaise the past couple of years have been characterised by. Economic (and geopolitical) turbulence has affected public and private markets alike. The high cost of debt, due to high interest rates, and the size of the pricing gap between buyers and sellers has suppressed deal activity too.

However, towards the end of 2024, we have started to see some green shoots emerging. As we look ahead to 2025, will this nascent recovery be sustained, and what are the key strategies for private investors to consider? Here, we outline our expectations for the coming year, and what that will mean for investing in private markets.

A busier time for deal-making

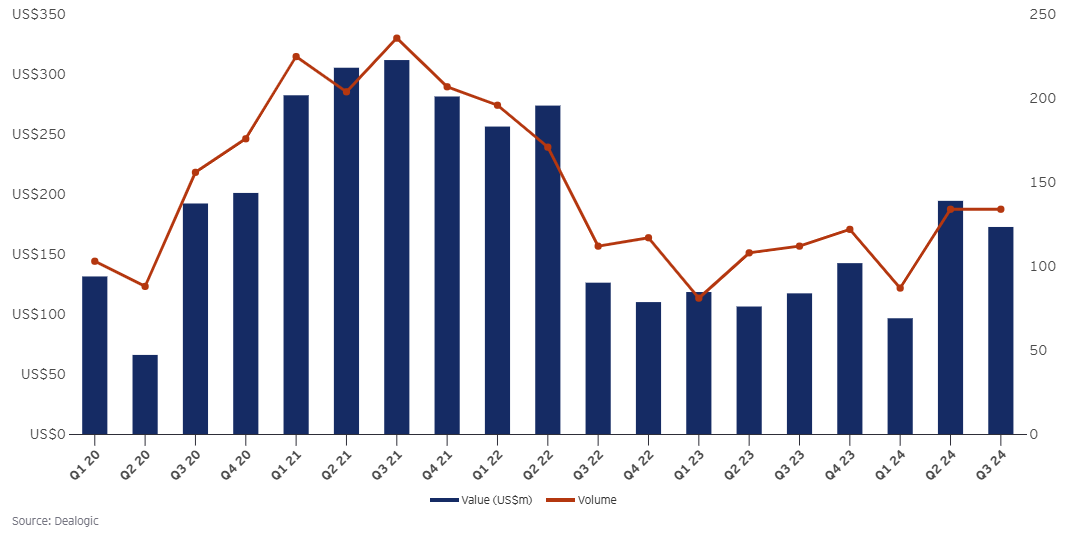

Falling interest rates, lower inflation, and a narrowing gap between buyers’ and sellers’ pricing expectations had started to fuel a visible uptick in deal-making towards the end of 2024, with Q3 tracking 36% higher by value (and 18% by volume) than the same period the previous year1. We certainly saw our own activity accelerating, with exits from Starbucks licensee 23.5 Degrees (9x gross return on initial investment) and The Light providing liquidity to clients and contributing to total 2024 distributions from across our platform of £63m.

Global private equity acquisitions by quarter (source: Dealogic/EY)

Though there may still be some way to go before buyers and sellers reach common ground on what represents “fair value”, there are signs that viewpoints on this subject are moving in the right direction.

There’s good reason to think this upward trend in deal-making will continue, given that there is significant pent-up desire to transact in the market, resulting in a more positive environment for exits and improving liquidity for investors. Indeed, 84% of respondents to a recent survey by KPMG expect to see more private equity activity in 20252.

Investors are likely to be selective, however – not just in terms of whether they think a company is priced appropriately, but also in terms of the strength of the sector. In our view, businesses which leverage human capital, such as those in financial services, business services and technology will have a natural defence from the recently announced increases in National Insurance, and those that may be in line to benefit from new government policies in areas like healthcare and housebuilding are likely to be among the strongest investment prospects.

A strong co-investment market

Demand has been growing significantly for co-investment opportunities in recent years. So much so that the amount of capital being deployed in such deals is five times higher than five years ago (hitting $31bn in 2023)3, and assets under management (AUM) are said to have tripled to $240bn in a similar time period4. All of which demonstrates the extent to which co-investments represent a growing share of the private equity market.

The co-investment space looks likely to continue to expand as both fund managers and investors see co-investments as a win-win option. It’s an approach that enables managers to raise the funds they need from a broader range of sources (which has proved invaluable in a tight fundraising environment), and investors to be strategic about the investments they make, because they can effectively cherry-pick the best assets on a deal-by-deal basis from fund portfolios.

As appetite for these kinds of deals increases along with the scope of opportunities, we’ve established an excellent position in the market ourselves, which has seen us offer eight co-investment opportunities in 2024, spanning the consumer (Crosta & Mollica), pharma (LXO Group), tech (IQGeo) and FinTech (Oxbury and Liberis) sectors, and with a strong pipeline ahead. We seek to work with high-quality private equity sponsors leading such co-investments.

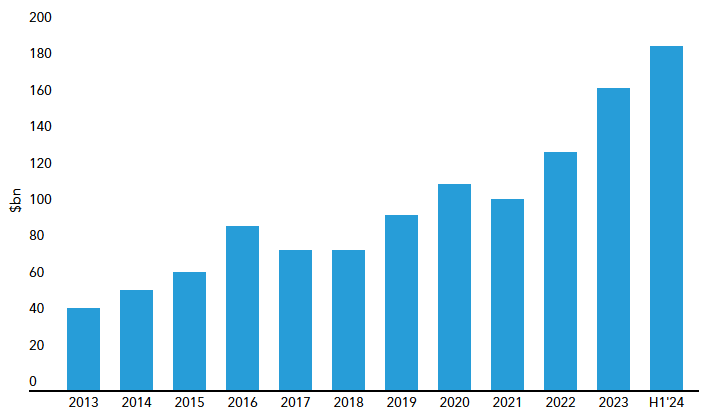

Continued demand for private equity secondaries

Fund managers that decide to hold onto assets for longer continue to be innovative about how to meet existing investors’ demands for liquidity via single- or multi-asset continuation vehicles. Meanwhile, incoming investors are being opportunistic about seizing opportunities to invest in quality assets, often at discounts to net asset value (NAV), at a more mature stage to reduce risk and accelerate returns.

Several sources point to the first half of 2024 setting a high water mark for activity in private equity secondaries deals, with investment volumes in the region of $70bn, prompting predictions of a record year overall5. With dry powder also at record-breaking levels, new entrants bringing significant capital into the market (to the tune of $22bn)6, and an estimated $3.2 trillion tied up in unrealised fund portfolios, there’s going to be plenty more where this came from.

Secondary Dry Powder Availability (source: Evercore/Secondaries Investor)

Connection Capital has offered secondary opportunities to clients through a Continuation Vehicle investment in specialist insurance broker BMS, and a specialist secondaries fund from a blue-chip manager.

Venture Capital moving back into the spotlight

After sharp falls in venture capital (VC) valuations from their 2021 peak, valuation levels have started to rebound7. Data from Pitchbook indicates that median deal values across all stages in 2024 are on track to outpace 20238. This suggests that, as falling interest rates, lower inflation and an improving economic outlook buoy up growth prospects, investor confidence is being boosted, while there are still attractively-priced deals to be had.

As investors are once again starting to see significant potential for value creation in start-up and very early-stage businesses which could go on to become market leaders, they are both looking for new opportunities, and to increase their existing investments in VC funds that are performing strongly.

Given the heightened challenges of this market, more than ever, it pays to seek out specialist fund managers with proven track records of successful early-stage and growth VC investing across market cycles. They will have the expertise to source the best opportunities at the right price and the experience to take a long-term view.

Active management strategies will drive value

In the current climate when the economy remains sluggish and the cost of labour is rising, many companies (particularly small and medium sized enterprises (SMEs)) are feeling the financial squeeze. Even as interest rates come down, leveraging private equity deals highly only adds to the pressure, putting the brakes on growth and eroding investment returns.

Instead, an active management approach is likely to be a much better way to encourage growth and create real value. Many businesses would benefit from more than just capital: they flourish when they get access to hands-on, constructive support and guidance from specialist investors who understand their business and their market and are prepared to get involved to make a positive, demonstrable impact. This involvement could take many forms, from strategic advice on expansion strategy, bolstering the skillset of the management team and digitising their operations, to undertaking deeper turnaround and transformation strategies.

We look for this approach in the fund managers we work with (as well as being hands-on ourselves with our direct private equity investments) – but they need to have the specific skills and experience to make it work. Examples of specialist fund managers we’ve enabled our investors to access include Epiris, Rubicon and InvestIndustrial.

In their different ways, each of the factors outlined above should have a positive impact on the outlook going forward. As we head into 2025, notwithstanding new geopolitical uncertainties with an incoming US Presidency threatening tariffs and trade wars, the strengthening activity we started to see towards the end of the year is a sign that private markets are prepared to pick up pace, with the number and diversity of new investment opportunities expanding, and sentiment among businesses and investors slowly improving. We are hoping this means a steady and sustainable recovery with no surprises along the way!